Wait no more.

Waiting is frustrating for everyone. Now, that's a thing of the past with UOB Cards.

Get up to S$538 cash credit or 50,000 miles* when you apply now!

*T&Cs here

![]()

For new-to-bank customers, the process has been enhanced to be fast, simple, and secure with MyInfo.

No more endless fields to fill in and documents to upload+.

Fast application,

within 2-3 minutes.

Less fields to fill in and no documents to upload.

Real-time approval,

via SMS.

Card can be digitised for contactless payments immediately#.

FAQs

New-to-Bank applicants who use MyInfo to retrieve personal details and income information (CPF and Notice of Tax Assessment information), pass all screening steps and income checks are eligible for Instant Account Opening. The application must be submitted after 7am and before 8pm.

Existing-to-Bank applicants (with a UOB Principal Credit Card & Account) who apply via Internet Banking. Please note exclusions in Q2.

Applicants will receive a SMS notification to inform them that the Credit Card/Cashplus application(s) has/have been approved within minutes from submission.

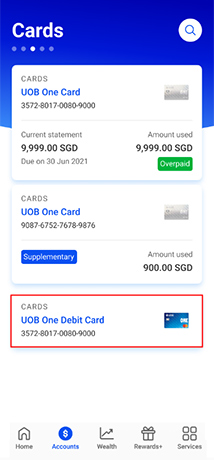

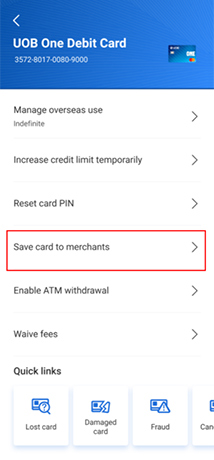

For Credit Card applicants, you can login to UOB TMRW (Android version only) to digitise your credit card for contactless purchases. The physical card will be ready 2 working days after approval and will be sent via normal mail. If you require your card earlier, please call 1800 222 2121 for more information.

Due to the current covid-19 situation, there may be a delay in the processing of your card application. International Postage service by our mailing provider is also currently suspended until further notice. For urgent queries, please contact our call centre.

Please allow 3-5 working days or longer for processing if you are:

- An applicant who has missing mandatory information;

- An existing-to-bank applicant who uses MyInfo or chooses the manual form filling route;

- An existing-to-bank applicant holding a different NRIC/Passport/PR number from bank records; you may be required to go down to a UOB branch for these updates

- An existing-to-bank applicant customers with changes to personal details (e.g. residential address); you may be required to go down to a UOB branch for these updates

- A new-to-bank applicant that fails any screening steps, e.g. income. KYC checks.

- A new to-bank applicant that applies between 8pm to 7am

Applications not accompanied by the required documents or with incomplete information will also result in a delay.

Note : Supplementary Cards have to be applied separately

MyInfo is a consent-based personal data platform for SingPass users to manage the use of their data for online account opening/ transactions with participating government agencies and commercial entities. By leveraging on MyInfo, Singapore citizens/PRs can skip filling in personal data repeatedly for every electronic transaction, while enjoying greater convenience like submitting fewer verification documents. All SingPass account holders (Singaporeans and PRs) will have their profiles enabled in MyInfo. For more information, visit www.myinfo.gov.sg.

UOB is embarking on MyInfo integration to simplify opening of new bank accounts and will be using it to update personal details or to provide the bank with income information.

You do not need to create a MyInfo profile as all users (Singaporean and PR) with a SingPass account will be auto-enrolled for MyInfo. Consent will be required by you to enable UOB to pull your data from government agencies from MyInfo, if it is the first time you are using it.

You can register for a Singpass account via https://www.singpass.gov.sg/singpass/register/registerinstructions

- support@myinfo.gov.sg or

- +65 6643 0567

- Mon - Fri: 8.00am to 8.00pm

- Sat: 8.00am to 2.00pm

- Sun and Public Holiday: Closed

Your MyInfo profile contains personal data as registered with various participating Government agencies. Please contact the relevant source agency or MyInfo if any field is incorrect (you may refer to the tooltip of each corresponding field for additional details).

You may be notified via SMS and/or a notification email/letter will be sent to you.

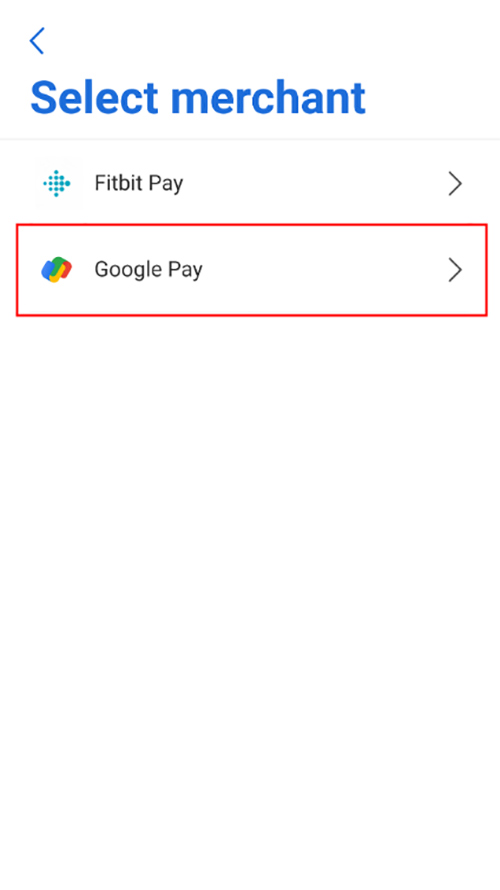

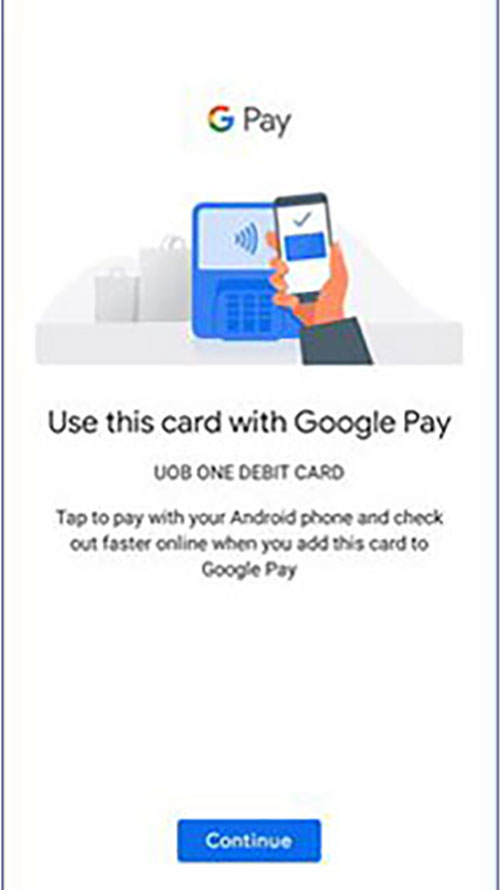

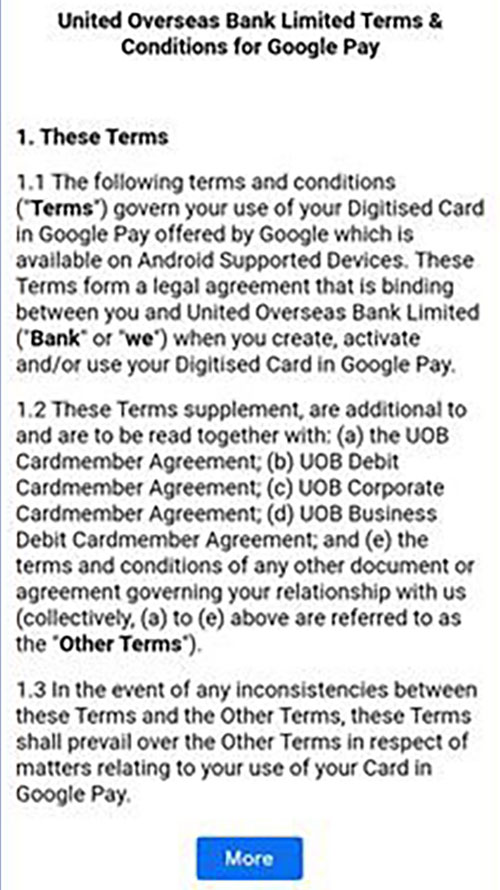

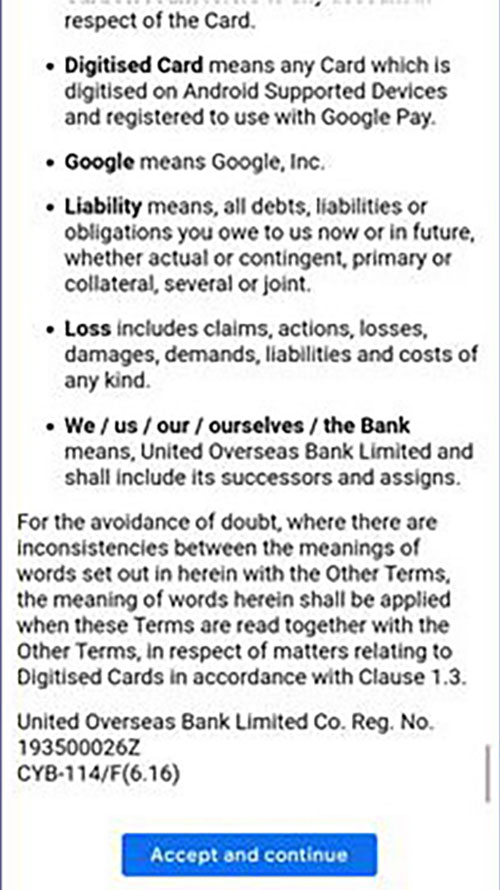

For Android device users, you can add your new Visa or Mastercard Card in Google Pay via UOB TMRW. For more details and a step-by-step guide, click here.

For Apple device users, you can add your new Visa or Mastercard Card in Apple Pay when you receive your physical Card. For more details and a step-by-step guide, click here.

Once your new Card is added in Google Pay or Apple Pay, you can pay with a tap at over 50,000 Visa payWave and MasterCard contactless terminals in Singapore.

Please note that the UOB PRVI Miles American Express®, Preferred Platinum American Express, Absolute Cashback American Express and UOB Union Pay Cards are not eligible for mobile contactless payment.

Customers who select same day delivery for their physical Card

Your physical Card is in transit by post and UOB has enabled a security feature to restrict adding of the Card for contactless payment. Once you have received the physical Card and activated it, you will be able to add your Card to make contactless payments.

Please note that the UOB PRVI Miles American Express®, Preferred Platinum American Express, Absolute Cashback American Express and UOB Union Pay Cards are not eligible for mobile contactless payment.

ALL CARDS

GET UP TO S$538 CASH CREDIT*

For the first 200 new-to-UOB credit card customers who successfully apply for an eligible UOB Credit Card between 1 September 2023 and 30 September 2023

(both dates inclusive) and spend a min. of S$1,000 per month for 2 consecutive months from their card approval date, they will receive either S$350 Cash Credit or UNI$ 12,600 (equivalent to 25,200 miles).

*Click here for S$350 Cash Credit full terms and conditions.

*Click here for up to S$58 cash credit full terms and conditions.

*Click here for up to S$130 cash credit full terms and conditions.

UOB PRVI MILES CARD

GET UP TO 50,000 MILES!

Up to 50,000 miles guaranteed for new-to-UOB Credit Cardmembers who pay 1st year Annual Fee

• 45,200 miles: Spend min. S$1,000 spend per month for 2 consecutive months from card approval date AND with first year annual fee payment of S$240 (subject to prevailing GST). SMS PMAF‹space›last 4 alphanumeric of NRIC/passport to register by 30 September 2023

• 4,800 miles: With min. overseas spend of S$1,000 per month for 2 consecutive months.

Click here for full terms and conditions.

Up to 30,000 miles for new-to-UOB Credit Cardmembers with 1st year Annual Fee waived (Capped at first 200 eligible cardmembers)

• 25,200 miles: Spend min. S$1,000 spend per month for 2 consecutive months from card approval date

• 4,800 miles: With min. overseas spend of S$1,000 per month for 2 consecutive months.

Click here for full terms and conditions.

UOB ONE CREDIT CARD

GET UP TO 15% CASHBACK PLUS GET UP TO S$538 CASH CREDIT*

15% cashback: For New-to-UOB Credit Card customers who successfully apply between 1 July 2023 to 31 December 2023 and qualify for the quarterly cashback will get an enhanced partner cashback of up to 6.67% on the total DFI Retail Group merchants such as Cold Storage, CS Fresh Giant, Guardian, 7-Eleven, Marketplace, Jasons, Jasons Deli, Grab, Shopee Singapore transactions, SimplyGo (bus and train rides) and UOB Travel transactions successfully posted to the Card Account in each statement month. Enhanced cashback will be capped at S$100 per month for first 2 quarters.

S$350 Cash Credit: For the first 200 new-to-UOB credit card customers who successfully apply for an eligible UOB Credit Card between 1 September 2023 to 30 September 2023 (both dates inclusive) and spend a min. of S$1,000 per month for 2 consecutive months from their card approval date, they will receive S$350 Cash Credit.

*Click here for 15% cashback full terms and conditions.

*Click here for S$350 Cash Credit full terms and conditions.

*Click here for up to S$58 cash credit full terms and conditions.

*Click here for up to S$130 cash credit full terms and conditions.

UOB KRISFLYER CREDIT CARD

GET UP TO 31,000 MILES!

For new-to-UOB credit card customers who successfully apply for an eligible KrisFlyer UOB Credit Card from 1 August to 30 September 2023 and spend a min. of S$2,000 within 60 days of the card approval date on their new KrisFlyer UOB Credit Card. For full details, visit KrisFlyer UOB Credit Card website.

Click here for full terms and conditions.

UOB EVOL CREDIT CARD

Get S$500 worth of Grab vouchers when you sign up now!

Promotion is only valid from 1 August 2023 to 31 October 2023 (“Promo Period”). Only valid for new-to-UOB Credit Card customers who apply for a UOB EVOL Card during the Promo Period and spend a min. of S$1,000 per month for 2 consecutive months on their new UOB EVOL Card within 60 days from their card approval date (“Qualifying Spend”). Participants are also required to register via SMS in the prescribed format during the Promo Period. Gifts are awarded to the top 100 participants in each calendar month to meet the Qualifying Spend within the least total number of days. A total of 300 gifts (i.e. 100 gifts per calendar month of the Promo Period) will be awarded under this Promotion. T&Cs apply.

Click here for full terms and conditions.